$Lana: A Comprehensive Review of Its Loan Services

Welcome to the future of financing! In a world where traditional banking can often feel cumbersome and out of touch, $Lana is stepping in as a breath of fresh air. Imagine accessing loan services that are not only user-friendly but also tailored to your unique financial journey. Whether you’re looking to consolidate debt, fund a dream project, or navigate unexpected expenses, $Lana promises an innovative approach that puts you at the center of its offerings. Join us as we dive deep into this modern lending platform—exploring its features, benefits, and what sets it apart from the crowded landscape of financial solutions. Get ready to discover how $Lana can transform your borrowing experience and empower you on your path toward financial freedom!

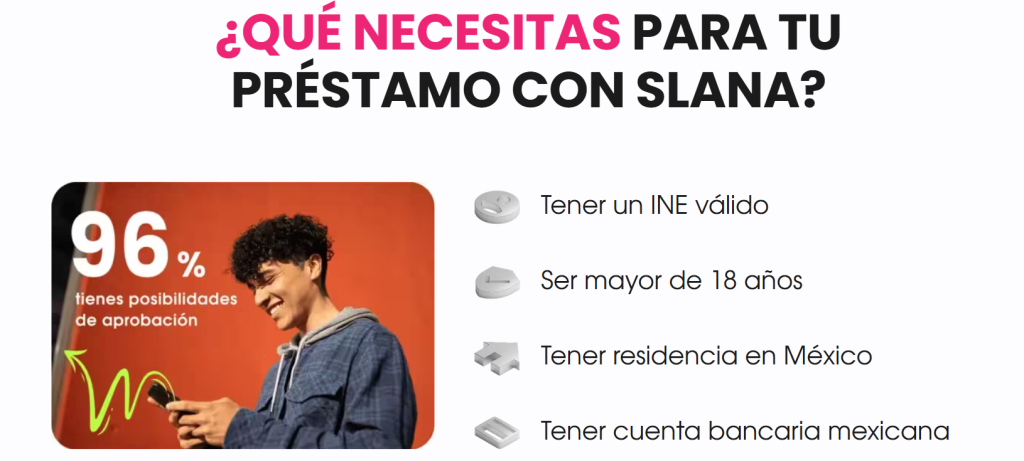

Introduction to $Lana and its loan services

In today’s fast-paced world, finding the right loan can feel like searching for a needle in a haystack. With so many options available, it’s crucial to choose a provider that not only meets your needs but also treats you fairly. Enter $Lana—a fresh player in the lending space that promises to simplify borrowing with its unique approach and user-friendly services. Whether you’re looking to finance a new car, cover unexpected expenses, or consolidate debt, $Lana aims to provide solutions tailored just for you. But what truly sets this platform apart? Join us as we dive into an in-depth review of $Lana’s loan services and discover if this innovative lender is the right fit for your financial journey.

What sets $Lana apart from other loan providers?

$Lana stands out in the crowded loan market due to its user-friendly digital platform. Borrowers can easily navigate through the application process, making it accessible for everyone. Another distinguishing feature is their personalized approach. $Lana offers tailored loan options that cater to individual financial situations, ensuring a better fit for each customer’s unique needs. Transparency is key with $Lana. They provide clear information about fees and terms upfront, reducing the chance of unpleasant surprises later on. This builds trust with borrowers who appreciate honesty in financial dealings. Additionally, $Lana emphasizes quick approval times. Many applicants receive decisions within hours, which can be crucial during emergencies or urgent financial needs. Lastly, excellent customer support rounds off their appeal. With knowledgeable representatives available to assist at every step, borrowers feel supported throughout the entire borrowing journey.

Types of loans offered by $Lana

$Lana offers a variety of loan products tailored to meet diverse financial needs. Personal loans are one of the most popular options, providing flexibility for unexpected expenses or major purchases. These loans typically come with straightforward terms and quick disbursement. For those looking to invest in their education, $Lana provides student loans designed to ease tuition burdens. With competitive rates and manageable repayment plans, students can focus on their studies without worrying about finances. Homeowners can benefit from home equity loans as well. This type allows borrowers to tap into their property’s value for renovations or debt consolidation. Additionally, $Lana features small business loans aimed at entrepreneurs seeking growth opportunities. With streamlined applications and favorable terms, these loans support ventures at various stages of development. This wide range ensures that almost anyone can find a suitable option within $Lana’s offerings.

Interest rates and repayment options

$Lana offers a range of interest rates tailored to different borrower profiles. Your credit score, income level, and loan amount can all influence the rate you receive. This flexibility ensures that many borrowers find an option that suits their financial situation. Repayment options are equally diverse, with choices including monthly installments or bi-weekly payments. These alternatives allow borrowers to select a schedule that fits their budget best. Additionally, $Lana provides early repayment features without penalties, enabling customers to save on interest if they choose to pay off their loans ahead of time. Such terms encourage responsible borrowing and offer financial freedom. Understanding your own financial landscape is crucial when selecting the right package from $Lana’s offerings. Personalized assistance is often available to help clarify any uncertainties surrounding these aspects.

Benefits of using $Lana for loans

Using $Lana for your loan needs comes with several compelling benefits. First, the application process is straightforward and user-friendly. It allows borrowers to navigate through it without unnecessary stress. Another advantage is speed. Many customers report quick approvals, which can be crucial during emergencies or time-sensitive situations. $Lana also prides itself on competitive interest rates. This aspect makes repayment easier over time, providing financial relief when managing monthly budgets. Additionally, customer support stands out at $Lana. Their team is accessible and ready to assist borrowers with any questions or concerns throughout the loan period. Lastly, flexibility in repayment options caters to various financial situations. Borrowers appreciate having choices that suit their unique circumstances without feeling cornered by rigid terms.

Customer reviews and experiences with $Lana loans

Customer feedback on $Lana loans paints a varied picture. Many borrowers appreciate the streamlined application process, noting that it’s user-friendly and efficient. The online platform allows for quick submissions, which can be a relief when funds are needed urgently. Others highlight the responsive customer service team. Users report prompt assistance with inquiries, providing reassurance during their loan experience. However, some reviews mention concerns regarding interest rates. A few customers feel that the costs associated with borrowing could be lower. Satisfaction seems strongest among those who valued transparency throughout the process. Clear communication about terms and repayment options has garnered positive remarks from several clients. As with any financial service, individual experiences vary widely. It’s essential to weigh these perspectives against personal needs before engaging in any lending agreement with $Lana.

Conclusion: Is $Lana the right choice for your borrowing needs?

When considering a loan provider, it’s essential to evaluate the services they offer against your specific financial needs. $Lana presents a range of options that may be appealing to many borrowers. With its streamlined application process and various types of loans, it caters well to those seeking flexibility. However, potential users should weigh both the benefits and any limitations before making a decision. Customer feedback can provide valuable insights into how $Lana operates in real-world scenarios. As with any financial product, conducting thorough research will ensure you make an informed choice. Ultimately, whether $Lana is the right fit for you depends on your unique situation and preferences. It’s wise to explore all available alternatives before committing to any loan provider.