Remitly Review: How to Send Money Abroad with Ease

Sending money abroad can be a daunting task, especially with all the complicated procedures and high fees that come along with it. But what if we told you there’s a way to send money overseas with ease? Introducing Remitly – an online money transfer service that promises fast and affordable transfers to over 50 countries worldwide. In this comprehensive review, we’ll take a closer look at how Remitly works, its key features, pricing structure, customer support, and more. So sit back, relax and read on to discover everything you need to know about sending money abroad hassle-free!

What is Remitly?

Remitly is a digital remittance company that makes sending money abroad easy and affordable. Launched in 2011, Remitly is one of the largest independent money transfer services in the world. The company offers safe and fast international money transfers to over 50 countries from the US, Canada, Australia, and the UK. Remitly’s mission is to make international money transfers simpler, faster, and more transparent. The company has an excellent reputation for customer service and security. In addition, Remitly offers competitive exchange rates and low fees.

How Does Remitly Work?

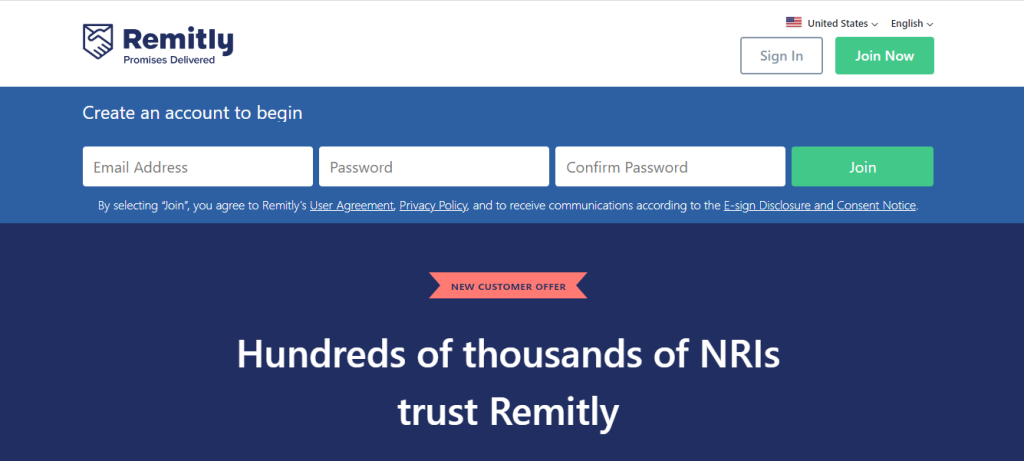

When you sign up for Remitly, you’ll need to enter some basic information about yourself and the recipient. You’ll also need to choose a payment method and register your bank account or debit card. Once you’ve registered, you can start sending money. To do this, you’ll need to enter the amount you want to send, the recipient’s bank account details, and a delivery date. You can also choose to have Remitly send the money as soon as possible or on a specific date. Once you’ve entered all the relevant information, you’ll be able to review and confirm your transaction. Once it’s been confirmed, the money will be sent to your recipient within minutes.

Advantages of Using Remitly

When you send money with Remitly, you can rest assured that your money will arrive quickly and safely. With more than 10 years of experience in the money transfer industry, Remitly has built a reputation for being a reliable and trustworthy company. Here are some of the advantages of using Remitly to send money abroad: – Your money is safe. Remitly uses state-of-the-art security measures to protect your money and personal information. – Your money arrives quickly. Remitly offers three different delivery options – Express, Prime, and Economy – so you can choose the one that best fits your needs. – You get great exchange rates. When you use Remitly, you’ll always get competitive exchange rates. – You can track your transfer. With Remitly’s tracking feature, you can see where your money is every step of the way. – There are no hidden fees. With Remitly, what you see is what you get. The price you pay to send your transfer is the only fee you’ll ever have to worry about.

Fees and Rates

When you sign up for Remitly, you’ll be asked to choose a sending plan. The three plans are Economy, Standard, and Express. Economy is the slowest and cheapest way to send money, while Express is the fastest but most expensive way. The exchange rate also plays a role in how much your transfer will cost. Remitly uses the mid-market exchange rate when converting your money, so you’ll always get a fair rate. However, they do add a small margin to this rate, so it’s not exactly the same as what you would get if you were to go directly to an exchange provider like XE.com. To see how much your transfer will cost in total, including fees and the exchange rate margin, just enter the amount of money you want to send into Remitly’s calculator on their website.

Services Offered

If you’re looking for an easy and affordable way to send money abroad, then Remitly is a great option. They offer a variety of services to make international money transfers simple and convenient. One of the most popular services offered by Remitly is their Express Transfer service. With this service, you can send money quickly and easily, with funds typically arriving within minutes. This is a great option if you need to send money for an emergency situation. Another popular service offered by Remitly is their Economy Transfer service. With this service, you can send money at a lower cost, with funds typically arriving within 2-5 business days. This is a great option if you’re looking to save on transfer fees. Remitly also offers a Mobile Money Transfer service. With this service, you can send money directly to a mobile wallet, such as M-Pesa or WorldRemit Wallet. This is a great option if you’re looking for a convenient way to send money to someone who doesn’t have a bank account.

Security & Reliability

When sending money abroad, it is important to choose a reliable and secure service. With Remitly, you can rest assured that your money is safe. Remitly is a licensed money transmitter in the United States, so you can be confident that your money is being handled securely. In addition, Remitly uses bank-level security measures to protect your information. You can also set up a PIN or use Touch ID for extra security. Reliability is also important when sending money abroad. With Remitly, you can track your transfer every step of the way. You will also receive email and text notifications when your transfer has been completed. Plus, if you need help, our customer support team is available 24/7.

Alternatives to Remitly

If you’re looking for an alternative to Remitly, there are a few other options available to send money abroad. WorldRemit: WorldRemit is an online money transfer service that offers fast, safe, and convenient international money transfers. With WorldRemit, you can send money to over 140 countries and receive funds in minutes. TransferWise: TransferWise is another popular online money transfer service that offers low-cost international money transfers. With TransferWise, you can send money to over 60 countries and receive funds in as little as 1-2 days. Xoom: Xoom is a digital money transfer service that allows you to send money worldwide. With Xoom, you can send money to over 30 countries and receive funds in as little as 1-2 days.

Conclusion

All in all, Remitly is an excellent money transfer service that allows users to easily and securely send money abroad. It offers competitive rates, low fees, and fast transfers with no hidden charges or complicated forms to fill out. With its user-friendly app and website, it has become a popular choice for those who need to send money overseas quickly and securely. If you’re looking for an easy way to send money abroad without having to worry about security or high fees, then Remitly is definitely worth considering.