Unlocking the Secrets of Western Union’s Exchange Rates: A Detailed Review

Welcome to our in-depth exploration of Western Union’s exchange rates! Whether you’re a frequent traveler, an expat sending money back home, or someone who simply needs to make an international payment, understanding how exchange rates work is vital. And when it comes to transferring funds across borders, Western Union has been a trusted name for decades.

In this blog post, we’ll delve into the intricacies of Western Union’s exchange rates and unveil some insider tips on getting the best deal possible. From uncovering the factors that affect these rates to comparing them with other money transfer options, we’ve got you covered! So get ready as we unlock the secrets behind one of the world’s leading remittance providers – Western Union. Let’s dive in!

Understanding Exchange Rates

Exchange rates play a crucial role in international money transfers, and it’s important to have a good grasp of how they work. The exchange rate determines the value of one currency in relation to another. When you send money through Western Union, the amount received by the recipient will depend on the prevailing exchange rate at that time.

Several factors influence exchange rates, including economic conditions, interest rates, political stability, inflation rates, and market demand for various currencies. These factors are constantly shifting and can cause fluctuations in exchange rates from day to day or even within minutes.

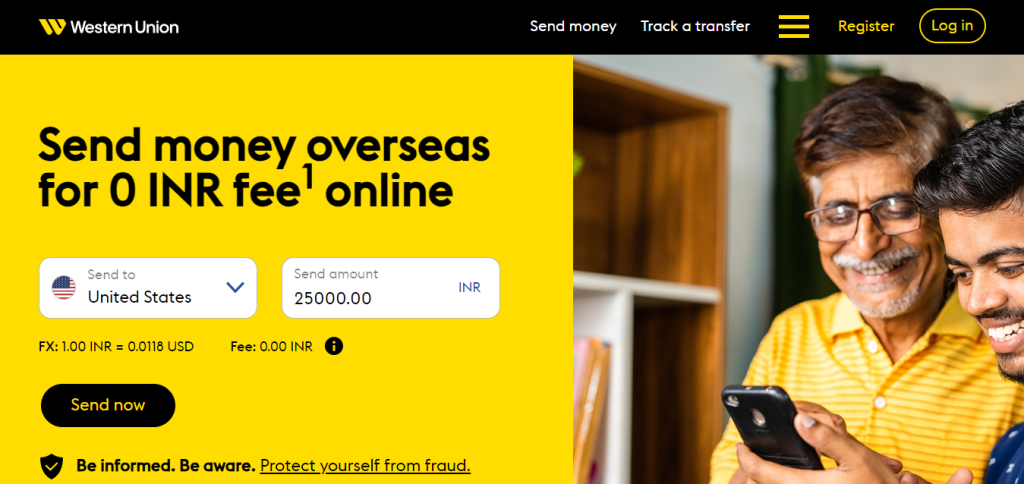

Western Union uses mid-market rates when converting your money into the desired currency. Mid-market rates are derived from multiple sources and provide a fair representation of current global currency values. However, keep in mind that Western Union also adds a margin or fee on top of this rate as part of their service.

To get an idea of what kind of rate you might expect with Western Union, you can use their online calculator tool or contact customer service for assistance. It’s always wise to compare their offered rate with other providers to ensure you’re getting the best deal possible.

In conclusion…

Understanding how exchange rates work is essential when using Western Union or any other money transfer service. By being aware of the factors that affect these rates and comparing options available to you, you can make informed decisions about your international transactions and potentially save some money along the way!

Factors Affecting Western Union’s Exchange Rates

When it comes to understanding exchange rates, it is important to consider the factors that can affect them. This holds true for Western Union as well. Here are some key variables that influence Western Union’s exchange rates.

1. Market Conditions: The fluctuating currency market plays a significant role in determining exchange rates. Supply and demand dynamics, geopolitical events, and economic indicators all impact currency values.

2. Fees and Commissions: Western Union charges fees and commissions on each transaction, which can affect the overall exchange rate you receive. It is crucial to factor these costs into your decision-making process.

3. Transfer Amount: The amount of money you are sending or receiving also affects the exchange rate offered by Western Union. Larger transfers may have more favorable rates compared to smaller ones.

4. Destination Country: Exchange rates vary from country to country due to differences in local economies, political stability, inflation rates, and other factors specific to each nation.

5. Timing of Transaction: Currency markets are constantly moving, so the timing of your transaction can impact the rate you get with Western Union. Keep an eye on market trends and make your transfer when conditions seem favorable.

By considering these factors when using Western Union for international money transfers, you can make informed decisions regarding your exchanges while maximizing value for your hard-earned money.

Tips for Getting the Best Exchange Rates with Western Union

When it comes to sending money internationally, finding the best exchange rates can make a big difference in how much your recipient receives. Here are some tips to help you get the most out of your currency exchange with Western Union.

1. Timing is key: Keep an eye on exchange rate fluctuations and send money when the rates are favorable. Currency values change constantly, so monitoring them regularly will give you a better chance of getting a good rate.

2. Compare options: While Western Union is a popular choice for international transfers, it’s always wise to compare rates and fees across different providers. Take advantage of online comparison tools to ensure you’re getting the best deal.

3. Consider alternative transfer methods: If speed isn’t your top priority, consider using other transfer methods like bank transfers or digital payment platforms that may offer lower fees or more competitive exchange rates.

4. Opt for local currency: When sending money overseas, choose to have it delivered in the local currency rather than your own. This way, you avoid additional conversion fees that can eat into your funds.

5. Utilize promotions and discounts: Keep an eye out for special offers or promotional codes that can help reduce transaction costs or provide better exchange rates when using Western Union’s services.

By following these tips, you’ll be well-equipped to navigate the world of international money transfers and find ways to maximize your savings when exchanging currencies with Western Union.

Comparison with Other Money Transfer Options

When it comes to sending money across borders, Western Union is just one option among many. While it offers convenience and reliability, there are other money transfer options that may better suit your needs.

One alternative worth considering is online payment platforms such as PayPal or Venmo. These services allow you to send money internationally at competitive rates and often offer lower fees compared to traditional methods like Western Union. Plus, they provide added convenience through their user-friendly interfaces and quick transactions.

Another option to explore is the use of international bank transfers. Many banks now offer this service, allowing you to transfer funds directly from your account to another country’s bank account. While this method may take longer than using Western Union, it can be a cost-effective solution for larger sums of money.

Cryptocurrency is also gaining popularity as a means of transferring funds globally. With platforms like Bitcoin or Ethereum, you can send money quickly and securely without the need for intermediaries like Western Union. However, keep in mind that cryptocurrencies can be volatile in value and may not be widely accepted by all recipients.

The choice between Western Union and other money transfer options depends on your specific requirements. Consider factors such as speed, cost-effectiveness, ease of use, and recipient preferences when making your decision.

Remember: It’s always wise to compare different providers before making any financial decisions!

Conclusion: Is Western Union the Right Choice for You?

After delving into the intricacies of Western Union’s exchange rates, it is clear that this global money transfer service offers convenience and accessibility. However, there are several factors to consider before deciding if Western Union is the right choice for you.

One of the major advantages of using Western Union is its widespread presence and extensive network. With thousands of locations worldwide, sending and receiving money becomes effortless. Additionally, their online platform provides a convenient way to manage transactions from the comfort of your own home.

However, it’s important to be aware that Western Union’s exchange rates may not always be as competitive as other options available in the market. While they provide transparency by disclosing fees upfront, their conversion rates may include additional charges or markups that can impact the final amount received by your recipient.

To ensure you get the best possible exchange rate with Western Union, here are some tips:

1. Compare Rates: Before proceeding with a transaction, take time to compare exchange rates offered by different providers. This will help you make an informed decision about which option offers better value for your money.

2. Timing Matters: Exchange rates fluctuate constantly due to various economic factors. Monitoring currency trends can help you choose an opportune moment to send funds when rates are favorable.

3. Consider Alternatives: While Western Union is a trusted name in money transfers, there are alternative providers who offer competitive rates and lower fees without compromising on security or speed.

Whether Western Union is the right choice for you depends on your specific needs and priorities – convenience versus cost-effectiveness. It’s recommended to weigh these factors carefully before making a decision.

In conclusion (without explicitly stating it), while Western Union provides a reliable means of transferring funds across borders with ease thanks to its vast network and user-friendly platforms; exploring alternatives might lead one towards potentially more affordable options with better exchange rates—providing greater value for each hard-earned dollar sent overseas.